Energy procurement decisions now sit at the intersection of business continuity, regulatory risk, and corporate responsibility. As regional energy markets evolve under new decarbonization policies, organizations must rethink how pricing, compliance planning, and long-term sustainability goals align. The pace of regulatory change demands more than transactional buying. It calls for strategies that transform volatility into opportunity.

Forward-thinking CFOs and general counsels are leading the shift toward integrated energy management that quantifies risk exposure and strengthens governance. They recognize that effective energy procurement requires visibility into policy trajectories and a deep understanding of market dynamics. With carbon mandates tightening and disclosure requirements expanding, every contract, pricing structure, and sourcing choice carries measurable implications across operations and compliance frameworks.

A disciplined approach to energy procurement safeguards against cost uncertainty while supporting measurable sustainability outcomes. For enterprises seeking to maintain financial control and meet emerging policy expectations, energy planning must merge data precision, regulatory insight, and strategic foresight into a single, actionable framework.

Mapping regulatory hotspots across your footprint

Every region has its own regulatory rhythm, and understanding where policies are tightening or trending can make a measurable difference in long-term planning. Some states are accelerating decarbonization goals with aggressive emissions targets, while others maintain flexible market structures that favor cost efficiency. These differences can reshape contract opportunities, pricing outlooks, and compliance timing.

A strong energy procurement strategy benefits from a clear map of where policy shifts are most likely to affect operations. Tracking pending legislation, renewable portfolio updates, and carbon reporting requirements allows organizations to anticipate rather than react. When regulatory hotspots are identified early, teams can adjust sourcing plans, contract terms, and investment priorities with greater confidence.

Keeping current with evolving rule changes across multiple jurisdictions helps maintain consistency in cost projections and risk assessments. In a market defined by regional diversity, staying informed positions enterprises to make procurement decisions that align with financial objectives and sustainability commitments.

Emerging regional policy trends to watch

Regulations shaping energy markets are moving at different speeds across the country, and these shifts are redefining where organizations face the greatest exposure. States with ambitious renewable portfolio standards are tightening procurement rules for carbon-intensive generation, while others are introducing incentives for localized clean energy production that influence procurement timing and contract structure.

Energy procurement strategies gain strength when they reflect how these regional differences evolve. In the Northeast and Mid-Atlantic, carbon caps and clean energy credits are influencing procurement terms and creating new opportunities to lock in renewable attributes. In parts of the Midwest and South, transmission planning reforms are expanding interconnection access, potentially lowering long-term supply costs for forward-looking buyers. Western markets continue to refine grid reliability measures and carbon accounting systems that directly affect sourcing transparency and compliance reporting.

Tracking how each region’s policy cycle advances helps enterprises anticipate cost drivers and compliance obligations before they reach the balance sheet. Visibility into these policy zones turns complex regional variation into actionable intelligence for structured, resilient energy procurement planning.

Integrating regulatory scenarios into electricity strategy

Energy strategy today relies on understanding how uncertainty shapes decision-making. Policy shifts, market volatility, and evolving compliance rules can all influence when and how organizations commit to electricity contracts. Shorter terms may protect against sudden regulatory change, while longer terms can secure near-term budget stability. Finding the right balance requires a clear view of potential scenarios and their financial implications.

Energy procurement planning benefits when contract decisions incorporate regulatory forecasting. Modeling how pending emissions rules or renewable standards could affect pricing helps identify which structures provide the strongest resilience. Some organizations accept a modest premium for flexibility, while others seek longer commitments that deliver stronger price advantages. Each approach depends on internal risk tolerance and the projected direction of policy.

Integrating regulatory analysis into electricity planning keeps decisions strategic rather than reactive. The goal is to build a procurement framework that adapts as conditions evolve while maintaining alignment with corporate sustainability and compliance objectives.

Scenario modeling as a financial tool

Understanding how policy changes affect pricing helps transform forecasting into a financial advantage. Scenario modeling allows teams to test how carbon pricing, renewable requirements, or emissions caps could influence electricity costs and contract performance. This approach turns broad regulatory uncertainty into measurable data points that can guide contract design and term selection.

Energy procurement strategies benefit from simulating multiple policy outcomes before commitments are finalized. Modeling the financial impact of low-, medium-, and high-regulation scenarios reveals where flexibility protects budgets and where longer terms may secure better pricing. These insights give finance and legal leaders a clear view of how policy trajectories intersect with cost exposure and risk tolerance.

When organizations incorporate scenario modeling into procurement planning, they move from reactive contract renewals to proactive, evidence-based decision-making. The result is stronger financial predictability and a clearer connection between policy readiness and enterprise value.

Compliance, reporting, and stakeholder expectations

Regulatory compliance is now tightly linked to how organizations demonstrate accountability and transparency. Expanded emissions reporting standards and ESG disclosure frameworks have raised expectations for data accuracy and performance visibility. Board oversight increasingly includes regular reviews of sustainability metrics, risk exposure, and progress toward decarbonization goals.

Energy procurement strategies that align with these expectations reinforce credibility and strengthen stakeholder trust. Integrating procurement data into ESG reporting connects energy decisions to broader corporate objectives. When sourcing choices reflect emission targets and policy readiness, organizations can showcase measurable progress while maintaining fiscal discipline.

Collaboration between finance, legal, and sustainability teams makes compliance planning more effective. Shared access to pricing data, contract insights, and emissions tracking supports consistent reporting and informed oversight. A unified approach helps transform compliance from a cost of doing business into a driver of reputation and long-term value.

Turning compliance data into strategic intelligence

Compliance data often holds untapped strategic value. When energy procurement metrics feed directly into ESG reporting systems, organizations gain a clearer line of sight between operational decisions and long-term sustainability goals. Tracking procurement performance alongside carbon intensity, contract terms, and renewable sourcing provides a data foundation that supports credible reporting and enhances stakeholder confidence.

Integrating these insights into board-level discussions shifts compliance from reactive disclosure to informed oversight. Leadership teams can use procurement data to evaluate progress against emissions targets, assess risk exposure, and identify opportunities for improvement across the energy portfolio. This approach strengthens transparency while aligning sustainability reporting with fiscal accountability and policy compliance.

When energy procurement information becomes part of enterprise intelligence, it empowers decision-makers to view regulatory performance and cost control through a single, consistent framework. The result is smarter strategy, stronger governance, and meaningful progress toward corporate climate commitments.

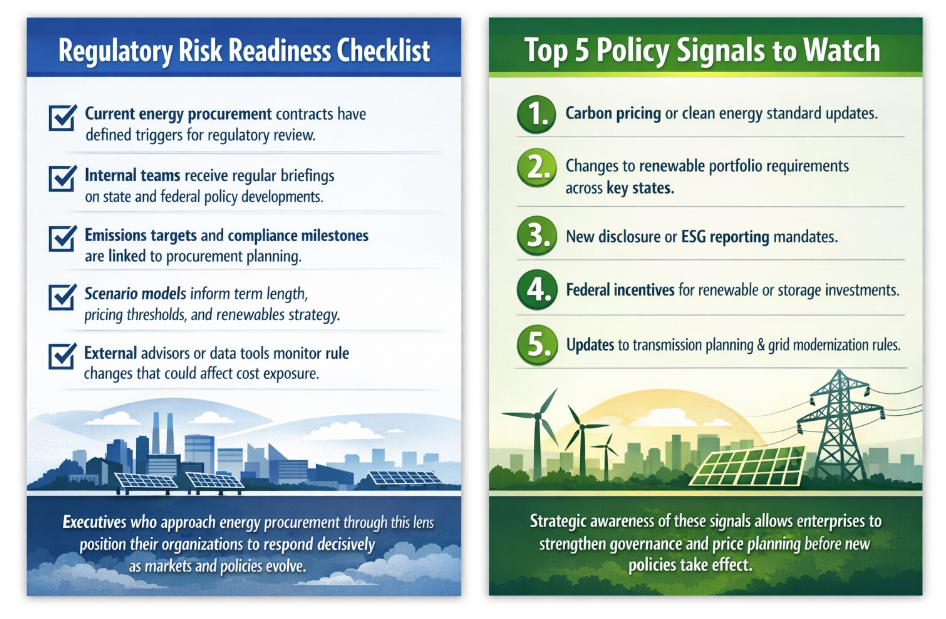

Building a repeatable regulatory risk playbook

Managing regulatory uncertainty becomes far more effective when organizations establish a consistent framework for action. Strong governance structures define who makes decisions, what triggers a review, and how thresholds are set for pricing, compliance, or operational impacts. Clear roles and repeatable processes give decision-makers confidence in fast-changing environments.

Energy procurement programs perform best when they incorporate these governance elements into day-to-day operations. Defining escalation triggers and predetermined response steps helps teams move from ad hoc reactions to structured, informed decisions. As new policies move through legislative or regulatory cycles, having agreed-upon decision points reduces guesswork and strengthens accountability.

External advisors play a valuable role in maintaining this framework. Access to real-time policy tracking, market analysis, and regulatory insights provides the data foundation needed to update assumptions and validate strategies. A repeatable playbook built around clear governance and expert input transforms regulatory risk management into a disciplined and measurable advantage.

Talk to Kb3 Advisors about making regulatory risk part of your enterprise energy strategy. Our team helps organizations turn evolving policy challenges into sustainable performance advantages.

Sources

- How Small Modular Reactor Laws Are Reshaping State Nuclear Energy Policy. multistate.us. Accessed January 26, 2026.

- 2025 ESG Wrap-Up and 2026 Outlook. corpgov.law.harvard.edu. Accessed January 26, 2026.